KUALA LUMPUR (Feb 28): The service tax scope expansion and rate hike from 6% to 8% on select services is expected to generate an extra RM3 billion in revenue for the government’s coffers, according to the Ministry of Finance (MOF).

The service tax’s scope expansion, which took effect on Monday (Feb 26), and the upcoming 2% tax rate hike effective this Friday (March 1), are done in order to support the government’s ongoing efforts to strengthen the country’s fiscal foundation.

“The expanded tax system is expected to generate an estimated additional RM3 billion in revenue to the country, which will help the Madani government increase its support for the rakyat through better social assistance schemes and improved critical public infrastructure like healthcare, schools and roads,” the MOF said in a statement on Wednesday.

The competition for tech talent has existed since before the outbreak of the Covid-19 pandemic and with tech advancing rapidly, there is a widening gap between the ever-changing needs of industries and the academic curriculum of tertiary educational institutions. To bridge this gap, passionate industry players are taking bold steps by providing upskilling opportunities that ensure graduates are industry-ready.

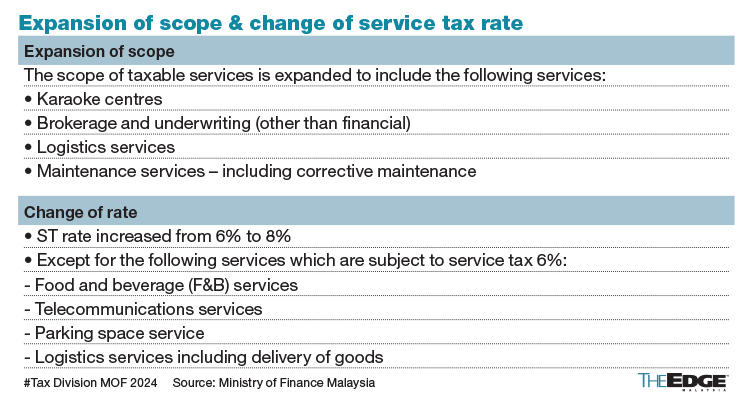

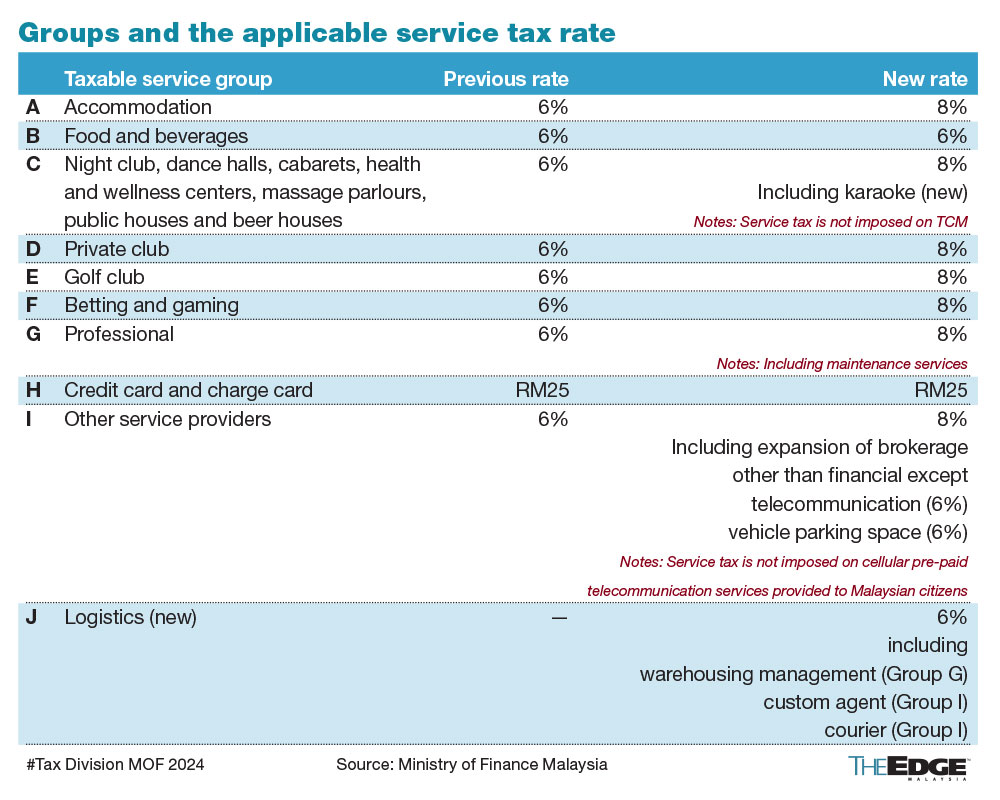

The service tax’s scope is expanded to include maintenance (preventive and corrective), brokerage, underwriting and karaoke services.

The services that will see its tax rate unchanged at 6% are logistics, food and beverage (F&B), telecommunications and parking space services.

For logistics services, service tax is exempted on a service that was procured by a customer, but subcontracted to another company. For example, if a customer procured for a haulage service for 1,400 containers to a logistics company, but the company could only provide the service for 700 containers, and procured another haulage service provider for the rest of the containers, service tax is exempted on the procurement of haulage services from the second provider.

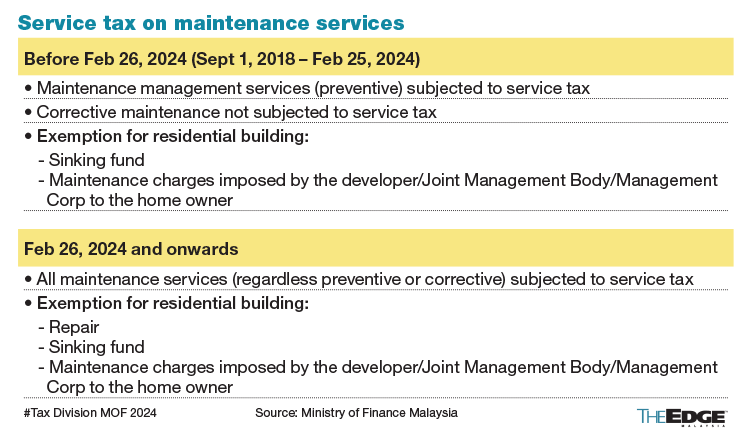

As for maintenance services, service tax is exempted for repairs, sinking funds, and maintenance charges imposed by a joint management body for residential buildings.

According to the MOF, new registered businesses will have by April 1 to implement the service tax on the newly taxable services, while existing registrants will begin implementing it on Friday.

“The government does not anticipate the changes to engender sharp price increases that would lead to an economic shock as the small two-percentage increase affects selected taxable services,” it added.

According to the MOF, the service tax amendments have been designed to protect the rakyat from shouldering higher consumption tax for key essential services, reiterating that the tax rate hike from 6% to 8% will not affect key essential services, such as food and beverage, telecommunications, parking and logistics.

The ministry noted that for electricity services, the service tax is only applicable for usage above 600kWh — equivalent to an electricity bill of RM219.80.

“Almost 85% [of] electricity users fall below this threshold, and therefore will not be affected by the service tax,” it said, adding that service tax does not apply to treated water supply services.

“To truly transform our economy, the government has taken a measured approach to reform our tax system. While it is important for the government to raise its revenue, there is a balancing act that we have to consider between improving the tax base and cushioning the rakyat from any undue burden,” said Minister of Finance II Datuk Seri Amir Hamzah Azizan.

“It is necessary for us to broaden the tax base to realign and strengthen our national fiscal foundation as we set the stage for a new era of economic growth under the Ekonomi Madani framework. At the same time, we will continue to take on a ‘Whole of Government’ approach to right our economic trajectory, including being more prudent in our spending, reducing leakages and attract FDI (foreign direct investments),” Amir Hamzah added.

Malaysia has been trying to shrink a long running fiscal deficit that stretches back to the 1998 Asian Financial Crisis. Most recently, the government has introduced a slew of measures ranging from trimming subsidies to imposing additional taxes in a bid to fix its weakened finances.

This year, the government is targeting to narrow its budget gap as a proportion of economic output to 4.3% from 5% last year.

Surprise inclusion of maintenance and repair services due to internal shortcomings

The inclusion of maintenance and repair services under the taxable scope of the service came as a surprise to tax consultants as it was not previously announced under Budget 2024, which listed the inclusion of logistics, brokerage, underwriting and karaoke services.

At a media briefing on Wednesday, MOF Treasury secretary general Datuk Johan Mahmood Merican explained that the wider scope of the service tax than what was previously announced in Budget 2024 was the result of ongoing engagements with industries, and was to ensure consistency of tax treatments.

“It is the shortcoming of me and my team…we should have [had] more extensive communications [prior to the national budget],” Johan commented when asked why the wider scope of the service tax was not included in Budget 2024.

By Izzul Ikram.

Source: The Edge Malaysia. https://theedgemalaysia.com/node/702760. 28 February 2024.

You may also like

Container freight rates take a breather

Container freight rates take a breather. The spike in spot container freight rates has flattened off over the last week. The Drewry World Container Index (WCI,) which has been seeing double-digit percentage weekly increases recently, was up just 1% over the previous week on 11 July at $5,901 per feu. The Shanghai Containerized Freight Index (SCFI) slid 1% to 3674.86 [...]

Chinese oil demand likely to underpin tanker market in medium-term

Chinese oil demand likely to underpin tanker market in medium-term. Rising oil demand in China is likely to be a key factor in supporting the tanker market in the coming years, according to analysis from New York broker, Poten & Partners. Following a sharp downturn in tanker contracting that saw the orderbook plunge to new lows before tanker owners started [...]

Singapore port operator says vessel waiting time reduced to two days

Singapore port operator says vessel waiting time reduced to two days. PSA Singapore has been grappling congestion caused by the Red Sea crisis and has been reactivating berths that had been previously been closed down. A combination of longer rerouting of container ships via the Cape of Good Hope to avoid attacks by the Houthi in the Red Sea and [...]