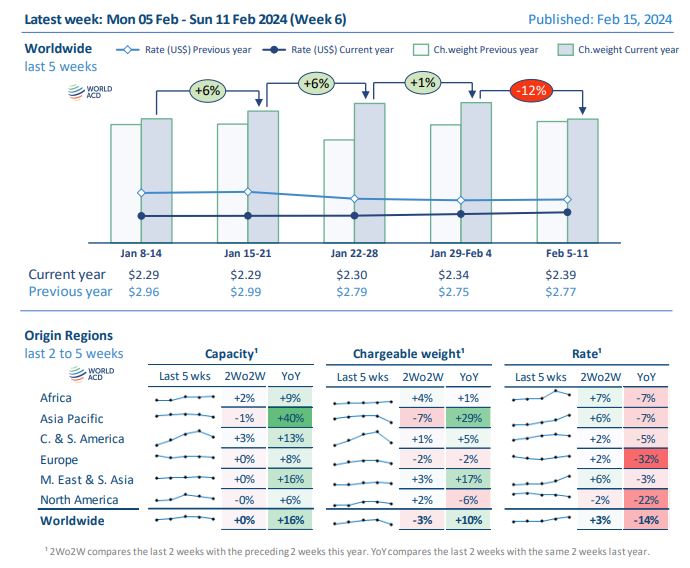

The latest figures show that the air cargo market is beginning to cool after a brisk start to the year caused by the Red Sea crisis and pre-Lunar New Year (LNY) rush.

Figures from analyst WorldACD show that in week six, tonnages out of China declined by 2% compared with the previous week while imports were down 15%.

This slowdown follows a “recent surge” in cargo volumes out of China as shippers “rushed to get goods shipped before the LNY holiday”.

And WorldACD expects both inbound and outbound tonnages to fall further this week.

Looking at the last two weeks, volumes also showed signs of a slowdown with global demand dropping by 3% compared with the preceding two weeks.

“The 3% worldwide tonnage decline was largely driven by a 7% drop in tonnages from Asia Pacific origins – which, in turn, was mainly generated by a 17% fall in intra-Asia Pacific traffic, with the intra-Asia Pacific market apparently responding more quickly than the main long-haul markets to the arrival of the LNY holiday period,” WorldACD said.

The analyst has also consistently pointed out over recent weeks that it is hard to gauge the underlying strength of the air cargo market during the first two months of the year due to the movement of the LNY holiday.

Last year, the two-week break took place on January 22 while this year it started on February 10.

“Initial analysis suggests that the patterns this year are broadly similar to last year, although global tonnages so far are well above last year’s levels. But the relative timings of LNY are significantly different,” WorldACD said.

It added that a “clearer picture will emerge by the end of this month”.

Taiwan-based freight forwarder Dimerco also found that the market had been slowing in the run-up to the LNY.

“The airfreight market exhibits a subdued demeanour as the Chinese New Year draws near, reflecting a sluggish demand and limited shifts from ocean to airfreight, compounded by the Red Sea crisis.

“With demand slowing down, airlines anticipate the cancellation of several flights during the Chinese New Year holiday due to reduced cargo volumes, posing additional challenges for the industry.”

Dimerco even reported that some manufacturers had closed sites early due to dwindling demand.

Earlier this week, freight forwarder Scan Global Logistics (SGL) said that it also believed that once the LNY was over the air cargo market would cool.

“We do not expect this to be a sustained situation, and our assessment remains that the development in recent weeks more so pertains to a last rush ahead of the Lunar New Year, and not least the effect from Red Sea delays, prompting shippers across Europe and US to utilise airfreight to avoid empty shelves and stock-outs,” the company said.

It added: “Considering that the traditional airfreight peak season in November and December also came in stronger than expected, this all points to the conclusion that the cargo airfreight market is steadily improving from a volume perspective following a tough landing after the pandemic.”

Source: WorldACD

By Damian Brett. 16 February 2024.

Source: Air Cargo News. https://www.aircargonews.net/business/supply-chains/air-cargo-market-shows-signs-of-cooling-after-busy-start-to-2024/. 16 February 2024.

You may also like

Container freight rates take a breather

Container freight rates take a breather. The spike in spot container freight rates has flattened off over the last week. The Drewry World Container Index (WCI,) which has been seeing double-digit percentage weekly increases recently, was up just 1% over the previous week on 11 July at $5,901 per feu. The Shanghai Containerized Freight Index (SCFI) slid 1% to 3674.86 [...]

Chinese oil demand likely to underpin tanker market in medium-term

Chinese oil demand likely to underpin tanker market in medium-term. Rising oil demand in China is likely to be a key factor in supporting the tanker market in the coming years, according to analysis from New York broker, Poten & Partners. Following a sharp downturn in tanker contracting that saw the orderbook plunge to new lows before tanker owners started [...]

Singapore port operator says vessel waiting time reduced to two days

Singapore port operator says vessel waiting time reduced to two days. PSA Singapore has been grappling congestion caused by the Red Sea crisis and has been reactivating berths that had been previously been closed down. A combination of longer rerouting of container ships via the Cape of Good Hope to avoid attacks by the Houthi in the Red Sea and [...]